Selling a Business: Seller Mistakes

21 August 2023: Selling a Business: Seller Mistakes

Why don’t some businesses sell?

Well, aside from the most obvious – price expectation – there are dozens of reasons, many of which we’ve encountered over our more than two decades in the business brokering trenches and have explored in posts on this blog over the past five years or so.

Most of these mistakes relate, in one way or another, to the preparation period leading up to any efforts to sell. This condition is surprising given the high stakes involved. According to the Exit Planning Institute (EPI), an estimated 80%-90% of business owners have most, if not all, of their financial assets tied up in their business.

__________________________________________________________________________________

We offer a comprehensive coaching program – both group coaching in our Brokers’ Roundtable℠ community as well as one-on-one coaching – tailored to Realtors, business owners, buyers and anyone interested in valuing, buying or selling a business.

If you’d like to learn more, email me at jo*@*******************og.com

___________________________________________________________________________________

When the time comes to sell – and it will – the financial result and the seller’s subsequent quality of life will largely depend on how well the sellers have prepared. Let’s look at a couple of the mistakes we’ve seen.

Failure to Plan for the Sale

Far too many business owners don’t have an exit plan. Even those with a vague semblance of a plan have not considered the wide range of scenarios that could dramatically impact the business, its valuation, the likelihood of a sale and the owner’s life post closing.

Some of those scenarios include divorce, partnership dissolution, lawsuits, a strategic buyer or PEG showing up and saying, “We want to buy your business.” The EPI estimates that half of all business exits in the U.S. are what it calls “involuntary” – due to death, divorce, disability, distress or discord.

An involuntary exit is a costly one and to avoid such a situation, the business owner should establish an annual “what if” meeting with advisors to imagine how the business – and the owners future lifestyle – would be impacted by any of these events.

As the saying goes, “failing to plan is planning to fail”.

_____________________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to accurately value and successfully sell businesses.

Failure to Enlist the Pros

As a rule, business owners are accustomed to running the show and many think that selling their business is no different than selling the construction equipment, seafood platters, real estate, hardware, fuel and assorted widgets that they’ve been selling for the past 10, 15 , 20 years. It is.

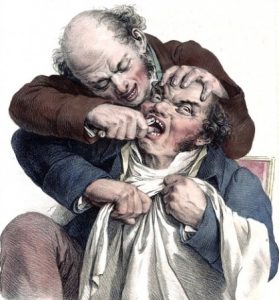

Selling a business is to any of those examples what auto repair is to dentistry. Like anything else, if you’re not trained in how to do something, trying to do that something without the right team is likely to end in disaster.

Selling a business is to any of those examples what auto repair is to dentistry. Like anything else, if you’re not trained in how to do something, trying to do that something without the right team is likely to end in disaster.

We’ve posted many examples of fiascos when business owners try to sell their own business or enlist the services of someone untrained in how to do so (real estate agents are the prime culprit here).

But the needed talent goes beyond just the M&A professional or business broker. A transaction attorney – someone who specializes in business transfers – not your divorce attorney or the guy that gets your kid’s 35-over speeding tickets reduced to “improper signaling”.

Many business owners start spending or planning how to use the $2.75M that the purchase contract contains in one of its first paragraphs as soon as the document is signed. But those owners will see a lot less than that, particularly if their planning has not included a tax professional to help them keep as much as possible.

In case you’ve been living in a cave with no WIFI, governments worldwide are broke and looking for more people to take more money from. The villains – and, thus, the targeted – are, naturally, “the rich”. But a business owner who’s been taking a modest annual salary of, say, $200,000 and who sells their business for $3 million is “rich” only for the year the business is sold – and is clobbered by the tax man. Advice from a tax professional will be worth FAR more than the advice will cost.

Failure to Plan for Life Post-Closing

If you’re a business owner, do you know what you’ll do when retirement arrives?

Whether you’re 45 or 65 years old, it’s extremely important to have some idea what you think your life will look like after the sale. If your post-closing life involves growing heirloom tomatoes and posting pictures of those beauties on Faceplant or InstaGramma, a certain type of (relatively modest) net worth is involved.

If , on the other hand, you plan to join the Formula-1 racing circuit, challenge Bezos in a “First-To-The Moon” contest or explore untold numbers of Tasmanian shipwrecks for gold, a completely different-looking bank account will be necessary.

If , on the other hand, you plan to join the Formula-1 racing circuit, challenge Bezos in a “First-To-The Moon” contest or explore untold numbers of Tasmanian shipwrecks for gold, a completely different-looking bank account will be necessary.

Planning for a post-closing life requires two things.

First, you need to have something to do. Whether it’s volunteering, traveling, teaching business courses, diving into Roman history, sailing around the world, starting a new business or, yes, growing heirloom tomatoes, most people – especially business owners – need a purpose, a reason to get out of bed in the morning and whatever that “something” is, it’ll cost money. This aspect of selling a business is extremely important.

Second, you must assure that, whatever you plan to do, you can afford to do. The amount of money you walk away with – and the timing with which you collect that money – will determine whether you’ll be able to do what you plan to do.

Next month, The Brokers Roundtable℠, the online community for business brokers, business owners, Realtors, lenders, appraisers and others in the business-for-sale industry, is launching the first in a series of live workshops. This first workshop is entitled “Buying PART of a Business”. It discusses the four fundamental elements that must be considered by buyers – and a fifth element that business owners looking for partners must consider. This program is for buyers and sellers alike.

Created and hosted by Worldwide Business Brokers, The Brokers Roundtable℠ provides training, webinars, workshops, live interviews and Q&As, and connections with professionals in our industry from certified business appraisers, acquisition lenders, accountants, franchise specialists, transaction attorneys, commercial realtors and business brokers in nearly a dozen countries.

Click here for more information – and to join The Brokers Roundtable℠!![]()

By now, you may be thinking that one of the most important aspects of planning is knowing what your business is worth. And you’d be correct. But this knowledge is important not only for when you plan to sell.

What would happen if you become disabled via a stroke or auto accident? Could the business run without you? What would happen if one of your partners was sued for divorce and 90% of that partner’s net worth was his or her equity in the business? Would you have the aggrieved spouse as a NEW partner? What would happen if one of your partners died suddenly? Would you now have their insolent children as board members?

As important, what would happen if someone – someone like us – showed up and said “we have a buyer for your business”?

The basis for a coherent answer to each of these questions is the same: you’ve got to know what your business is worth to be prepared for any of these scenarios.

The Bottom Line

If you’re a business owner, I hope you know – and firmly believe – that, unless it fails, your business is very likely going to be sold. But don’t think that you’re immune to the possibility of “death, divorce, disability, distress or discord.” You’re not. And if the EPI’s estimate that half of all exits are involuntary is accurate, you’re odds of escaping that fate are no better than 50/50.

Business owners know what their house is worth, what their car is probably worth, what their investment portfolio is worth, what their boat is worth. It’s a rare owner that knows what their business is worth, notwithstanding the fact that the value of their business most likely represents the vast majority of their wealth.

If you do nothing else to plan your exit, do this one thing. Get it valued. If a calamity befalls you, one of your partners or the business in general, having an idea as to its value will give you the ability to put in place some safeguards should worse come to worst.

I’d like to hear from you. What topics would you like me to cover? How can we tailor these posts to be more useful to you and your business. Let me know in the comments box, below, or email me at jo*@*******************og.com.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

NOTE TO READERS: Our “Searching For…” feature has been moved to our online community, The Brokers Roundtable℠. It will appear there exclusively from now on.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder, in 2001, of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 600 in the world. He can be reached at jo*@*******************og.com