08 July 2024: Selling Your Business: Some Options

If you’re thinking of selling your business, you have several options when it comes to choosing your likely or preferred buyers as well as the method of selling that makes most sense to you.

Having a plan for the sale of your business will make the process more manageable and much more likely to be successful. Knowing who your target buyer is and how you’ll go about reaching and negotiating with them are issues that must be considered before bringing your business to market.

WHAT WE’RE LOOKING FOR: Construction, materials, maintenance/repair. EBITDA: $200,000-$3 million. Location: Mid-Atlantic (U.S.) in**@**********************rs.com

Selling your business is likely to be the largest and most meaningful financial event of your life. To many business owners, it is also the most emotionally taxing, a condition that can clear decision-making. Your ultimate goals – financial and non-financial – must be clear to you and should be carefully considered and established before doing anything else.

For example, are you concerned about the future of your business after you sell it? Are you concerned about your employees? Do you have a post-closing life plan? Will the proceeds of the sale enable you to afford that plan? These are just some of the issues that should be addressed before any action is taken.

__________________________________________________________________________________

The calendar of events scheduled for this month in The Brokers Roundtable℠ is posted in the Announcements space. Don’t miss Office Hours (“Ask Me Anything”), workshops, Live Streams, Thursday Specials and more.

REALTORS: The Announcements space also has news you can use!

If you’re not yet a Member of The Brokers Roundtable℠, you can find out what other benefits Members enjoy – and join us – here.

___________________________________________________________________________________

Let’s first look at the issue of buyers.

Selling Your Business to Employees

This has a number of advantages and we’ve written about this approach before. After all, your employees know your business and selling to them is likely to make the transition easier and quicker. For example, it is unlikely you will be required to prepare the same level of documentation that will almost certainly be required for an external buyer.

This has a number of advantages and we’ve written about this approach before. After all, your employees know your business and selling to them is likely to make the transition easier and quicker. For example, it is unlikely you will be required to prepare the same level of documentation that will almost certainly be required for an external buyer.

A management or employee buyout is more likely to result in stability for the existing staff and business, and it is unlikely you will need to stay on for a long transitional period. This leaves you free to move on with your life quickly.

In some cases you may be asked to leave some money in the business via residual equity or as selling financing. But with the management or employees being the buyer, the risk of losing any future value is significantly reduced.

Selling to Family

Selling to a family member is more about succession planning. But more importantly, to accomplish this you must have a sufficiently interested, motivated and capable family member. They must be enthusiastic, willing to commit and be able to take over your business. It pays to have a formal process in place to prevent any misunderstandings or family issues. This ensures transparency and encourages open discussion.

We have a client who is approaching the point in her life when she is beginning to think about selling. She started her business more than 20 years ago and has built a solid company with a great reputation. One of the employees is her son and he has not only expressed interest in taking over the business but expects to take it over.

We’ve been consulting for this client for several years. She’s told us that her son’s original comments about taking over the business were based on his expectation that it would be handed to him. Our client had to inform him that, when the time came, it would be sold – and that he would have an opportunity to buy it. He’s now telling people that he’ll buy the business from his mother whenever she’s ready to ride off into the sunset.

We’ve been consulting for this client for several years. She’s told us that her son’s original comments about taking over the business were based on his expectation that it would be handed to him. Our client had to inform him that, when the time came, it would be sold – and that he would have an opportunity to buy it. He’s now telling people that he’ll buy the business from his mother whenever she’s ready to ride off into the sunset.

The problem is that, in spite of his mother giving him repeated opportunities to illustrate his motivation, knowledge and willingness to do what it takes to run this – or ANY – business, he has repeatedly been found wanting. He’s not motivated. He wants weekends off and to leave the office at 5 sharp. He’d rather hang with his friends than stay late to get that bid out.

We’ve had a couple of tough conversations with our client; her son may be loyal employee but he’s simply not business owner material.

Selling to an Outside Party

Though both selling to employees and selling to a family member can give the owner some comfort if the owner is concerned about his or her legacy, selling to an unrelated outside party is how most business owners exit their business.

Before creating an avatar of the most likely buyers, consider these questions:

- Would you sell to a competitor?

- Would you sell to a private equity group?

- Should you expose your business to the open market? (Confidentiality is very important.)

Each of these options comes with both positive and negative aspects and they must be weighed carefully.

__________________________________________________________________________________

Courses! Courses! Courses!

Many of you have asked if our Flagship Course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, could be made available on a module-by-module basis. Instead of enrolling in the complete course, could you enroll only in the module(s) you wanted? We’re happy to report that this is now possible.

We’ve broken our Flagship into six separate modules (or module groups) to give you all the flexibility you need to learn only what you want to learn – and we’ve moved them all over to the new Brokers Academy in The Brokers Roundtable℠ . The Flagship is still available but the modules are now available individually.

You don’t need to be a Member of The Brokers Roundtable℠ to access any of these courses but if you are, you’ll receive a 20% discount on any course you enroll in. If you’re not yet a member of The Brokers Roundtable℠, you can learn more – and get access to all the talent and resources – here.

___________________________________________________________________________________

For instance, selling to a competitor is a strategic transaction on the part of the buyer. But this could mean that your business is, for all intents and purposes, subsumed by the acquiring company. On the other hand, the acquiring company might see great value in your brand and the surviving entity might trade under your company’s name after the sale.

But exposing your business to the open market might be a consideration as this is likely to result in a somewhat higher value simply because more potential buyers would generally mean more bidders.

In the open market, you will also be dealing with financial buyers (as well as strategic ones): buyers that have no strategic reason for buying but are entrepreneurial types who are simply looking for a business to run.

We’ve written previously about financial versus strategic buyers and consideration should be given to both before deciding which would be best for reaching your goals.

_____________________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to accurately value and successfully sell businesses.

From the above discussion, you can probably see that selling your business is probably going to require a lot of work and a lot of time.

True. And that allows us to move our discussion to “method”.

Two General Methods

There are two overall methods of selling your business and they need careful consideration. Those methods are DIY and hiring a professional.

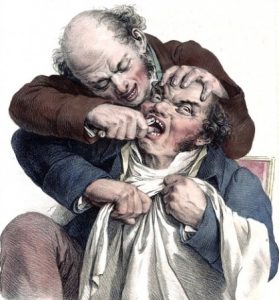

Do-it-yourself business brokering is not much different than do-it-yourself dentistry. There’s a remote chance that the operation will be successful and with no lingering deleterious aftereffects but the odds are stacked against such a benign outcome.

Do-it-yourself business brokering is not much different than do-it-yourself dentistry. There’s a remote chance that the operation will be successful and with no lingering deleterious aftereffects but the odds are stacked against such a benign outcome.

More importantly, the time spent preparing, packaging and marketing your business, as well as negotiating the deal, supporting the financing efforts and shepherding the transaction to closing will be taken from the time needed to actually RUN your business. And that’s if you know what you’re doing, a highly unlikely circumstance. Do-it-yourself business brokering is one of the top three reasons businesses don’t sell.

Professional representation, on the other hand, means there’s a good chance that those top three reasons are eliminated before the business is brought to market. Yes, like your attorney, accountant, financial planner, dentist and many others, professional representation will involve some cost. But it will save you hundreds of hours that you can invest in running and continuing to grow your business, adding to its value.

The Bottom Line

Selling any business is a process and following that process will increase your odds of success. We’ve developed a downloadable six-part series of posts explaining this process and it’s available in The Brokers Roundtable℠ in the Resources area. Making the decision about to whom you wish to sell should drive your decision about how to sell. But regardless of the “to whom”, you will be faced with some level of professional fees.

An attorney will be involved – hire a transaction attorney for this, not your divorce attorney! – as will an accountant and financial planner. You’ll need to know what your business will likely fetch in the open market to determine its value. As such, someone capable of valuing businesses – a professional accredited business broker or M&A specialist – will be involved.

Selling your business is likely to be the most significant financial event of your life and the one that will have the biggest impact on your future and that of your family. If you wouldn’t try to repair your own teeth – a task with FAR fewer and less calamitous financial downsides – it would seem to stand to reason that, when selling your business, one or more professionals would at least be consulted. (There’s a bunch of them in The Brokers Roundtable℠.)

Selling any business is a process and following that process will increase your odds of success. We’ve developed a downloadable six-part series of posts explaining this process and it’s available in The Brokers Roundtable℠ in the Resources area.

I’d like to hear from you. What topics would you like me to cover? How can we tailor these posts to be more useful to you and your business. Let me know in the comments box, below, or email me at jo*@*******************og.com.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

NOTE TO READERS: Our “Searching For…” feature has been moved to our online community, The Brokers Roundtable℠. It will appear there exclusively from now on.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder, in 2001, of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 600 in the world. He can be reached at jo*@*******************og.com