6 November 2023: Selling a Professional Practice: Pt 2

Last week’s post on selling a professional practice generated a couple of questions that suggest a need for some clarification. Though these aspects of transitioning out of a practice were discussed as part of the overall process of selling, they are generally applicable in most business transfers and, as such, worth diving into more deeply.

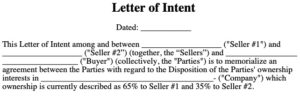

Letter of Intent

Many of you likely know that a Letter of Intent (“LOI”) is a document outlining one or more terms of an agreement – or, rather, an anticipated agreement – between two or more parties before all the agreement’s terms and conditions are finalized and memorialized in the hoped-for final agreement.

__________________________________________________________________________________

November’s event schedule on The Brokers Roundtable℠ is now published in the Announcements space. We expect at lease one additional LIVE event to be scheduled.

If you’re not a member of The Brokers Roundtable℠, you can find out what benefits membership includes and join here.

___________________________________________________________________________________

Some brokers, especially those in the commercial real estate markets, use the phrase “term sheet” in place of the LOI or even a memorandum of understanding (“MOU”). But all are generally used as an initial document to govern an anticipated material transaction.

In our opinion, a document using the term “memorandum of understanding” is our least favorite simply because it’s too squishy. It purports to state “here’s what the parties understand”.

In our opinion, a document using the term “memorandum of understanding” is our least favorite simply because it’s too squishy. It purports to state “here’s what the parties understand”.

A letter of intent states “intent”, as in “here’s what the parties intend”. This is the preliminary document we prefer and suggest all parties in our deals use.

We’re currently working with an eCommerce client that is attempting to: 1) acquire a larger company; 2) line up equity financing for the acquisition; and 3) negotiate a substantial agreement with a publicly-traded company. However, item 3 can happen only if items 1 and 2 are accomplished first.

Our client has been fooling around for several weeks trying to get MOUs drafted and signed for items 1 and 2 but those MOUs will essentially do nothing to allow the company to accomplish item 3, its ultimate goal. If our team wants to move the ball – and they need to – they’ve got to get the other entities to a decision – to a commitment; they’re either in or they’re out, but our client has to know which. A letter of intent is, in our opinion, stronger than an MOU even though, with the exception of the non-disclosure aspects, neither generally binds the parties to the terms outlined.

__________________________________________________________________________________

Courses! Courses! Courses!

Many of you have asked if our Flagship Course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, could be made available on a module-by-module basis. Instead of enrolling in the complete course, could you enroll only in the module you wanted? We’re happy to report that this is now possible.

We’ve broken our Flagship into six separate modules (or module groups) to give you all the flexibility you need to learn only what you want to learn – and we’ve moved them all over to the new Brokers Academy in The Brokers Roundtable℠ . The Flagship is still available but the modules are now available individually.

You don’t need to be a Member of The Brokers Roundtable℠ to access any of these courses but if you are, you’ll receive a 20% discount on any course you enroll in. If you’re not a member of The Brokers Roundtable℠, you can join here.

___________________________________________________________________________________

One component generally included in an LOI is that one of the parties – generally the buyer – will be responsible for drafting a proposed offer or final agreement. In the case of the eCommerce company, they need the owner of the target business to agree – in writing – to sell on certain terms and the financing company to agree to provide capital on certain other terms. The eCommerce company is the “buyer” in both instances. Until those agreements are in place, they can’t even have substantive conversations with the publicly-traded company.

An LOI is meant to lead to a final agreement – a purchase agreement in many cases – by a certain date and will require the parties to “negotiate in good faith” to conclude such negotiations by that “certain date”. While that “certain date’ is usually anything but “certain”, it’s a target that both parties, by executing the LOI, claim to want to hit. Without such a timeline in the LOI, the less-motivated party can simply drag discussions out endlessly – which is what has been happening to our client.

An LOI is meant to lead to a final agreement – a purchase agreement in many cases – by a certain date and will require the parties to “negotiate in good faith” to conclude such negotiations by that “certain date”. While that “certain date’ is usually anything but “certain”, it’s a target that both parties, by executing the LOI, claim to want to hit. Without such a timeline in the LOI, the less-motivated party can simply drag discussions out endlessly – which is what has been happening to our client.

Other conditions that should be considered in an LOI include confidentiality or non-disclosure agreements (NDAs), which contractually stipulate that the components of any deal – or even the discussions of any deal – are to be kept confidential by both parties. Many LOIs also feature no-solicitation provisions, which forbid the parties from poaching the other party’s employees, suppliers and customers.

The LOI should be as detailed as possible and should include essential terms such as monetary provisions, financing, contingencies, method of transition, risk allocation, timing, and document preparation. A well-drafted LOI improves the likelihood that the drafting of the final documents will be less contentious and that the transaction will proceed successfully.

Finally, many LOIs will contain a so-called “no shop” clause. This prevents the seller (and broker) from continuing to offer the business to other buyers while the potential buyer is conducting some of its investigations. Though we try to discourage “no-shop” clauses, sometimes they can’t be avoided. From the seller’s standpoint, the key to dealing with a “no-shop” is that it must sunset. An open-ended “no-shop” severely handicaps the seller in that the buyer can tie the business or practice up indefinitely.

Make sure any “no-shop” contained in an LOI has an ending date.

Lease (Contract) Review

Most businesses are parties to any number of agreements. Contracts to purchase raw materials and supplies, contracts to sell services or finished goods, equipment leases, premises leases, financing instruments, etc. Some of these agreements may contain “change of ownership” provisions that change the terms of the contract, void the contract or accelerate payment of any outstanding amounts owed should the business or practice be sold. Such “restrictive covenants” can kill a deal or, if undiscovered by the buyer prior to closing, kill any chance the buyer will succeed after the acquisition, an important consideration in that it could impact the seller.

Leases are typically a major issue in the sale of any business and the sale of a professional practice is no different. Many renewal clauses are written to become null and void if the practice or business is sold. A practice’s physical location is an important factor in its success. The seller should be upfront with their landlord and negotiate the lease terms long before the sale so the buyer gets a lease with a term and rate that provide adequate opportunity to remain successful – and to pay the seller!.

Such terms include renewal options and rent-escalation clauses. The buyer has to have confidence that they’ll be able to renew the lease in five years and at a rate determined by reasonable economic criteria.

_____________________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to accurately value and successfully sell businesses.

The Bottom Line

As mentioned last week, selling a professional practice is generally similar to selling any other business. In order to achieve the highest value, the business – or professional practice – must be be properly prepared. The scrutiny of contracts and leases to which the business is a party is an extremely important part of getting the business or practice looking as attractive – and, thus, valuable – as possible.

And once the business or practice is looking as good as it can and a buyer is identified, getting the most important terms of the sale written down and that writing signed by the parties will very likely reduce the potential for misunderstandings, delays and other roadblocks to a successful transition from the current owner to the next one.

I’d like to hear from you. What topics would you like me to cover? How can we tailor these posts to be more useful to you and your business. Let me know in the comments box, below, or email me at

jo*@Wo*******************.com

.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

NOTE TO READERS: Our “Searching For…” feature has been moved to our online community, The Brokers Roundtable℠. It will appear there exclusively from now on.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder, in 2001, of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 600 in the world. He can be reached at

jo*@Wo*******************.com