Selling a Business: No Regrets?

24 July 2023: Selling a Business: No Regrets?

A couple of months ago I read an article by Ben Guttman, one of the co-founders in 2011 of a digital marketing company. The story he told was generally about starting and growing the business, and reaching the exhilarating point of being acquired. But more specifically, it was about the ultimate demise of the firm he and his co-founders birthed and the emotional toll that resulted. (Though, regrettably, I can’t find the link to that article, you can find some of Ben’s writing on his blog.)

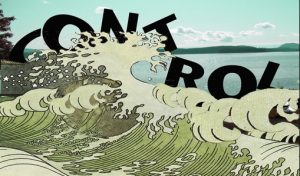

His story was about how he tried to prepare for the sale of his business and particularly his coming to grips with the fact that, whatever his future involvement might be, he would no longer be controlling the company he founded and grew and, to a certain extent, his own destiny.

The acquisition of his business included, as many acquisitions do, senior roles in the acquiring company for the founders of Ben’s company as well as positions for many of their employees. These were conditions he established early in the process. And though the article was in one sense general, it had a specific focus on what is arguably, to the founder, the most significant aspect of the sale of the business: the relinquishment of control and the consequent emotional impact.

The acquisition of his business included, as many acquisitions do, senior roles in the acquiring company for the founders of Ben’s company as well as positions for many of their employees. These were conditions he established early in the process. And though the article was in one sense general, it had a specific focus on what is arguably, to the founder, the most significant aspect of the sale of the business: the relinquishment of control and the consequent emotional impact.

__________________________________________________________________________________

We offer a comprehensive coaching program – both group coaching in our Brokers’ Roundtable℠ community as well as one-on-one coaching – tailored to Realtors, business owners, buyers and anyone interested in valuing, buying or selling a business.

If you’d like to learn more, email me at

jo*@Wo*******************.com

___________________________________________________________________________________

Those of you who have been following this blog for any period of time know that I had a similar experience when my business was acquired in the mid-’90s.

As founders we often “become” our business. It’s our identity and selling it can be an emotional earthquake of the first order. This is especially true if, as in my case, the owner is not prepared.

Preparation

Ben had more foresight. From his article:

“Exiting is not just about the sale price. Sure, money talks, but selling a business is selling a piece of yourself, and a career and personal inflection point. Money is but one factor alongside these.” (Emphasis added.)

With that understanding, he developed a list of five or six “must haves” an exit deal had to include and that list guided him during the process. And as important as that list was in the negotiations, the real topic of his article was the ultimate realization that, once the business was sold, he ceded all control to the new owners. The fate of his business at that point was out of his hands.

_____________________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to accurately value and successfully sell businesses.

As it happened, 10 months after the sale closed, everything vanished.

To quote again from his article:

“It took ten years to build the (business). 18 months to find our perfect buyers. Six months to close the deal. And just ten months to dissolve the entire thing.”

Who’s The Boss?

As with many Lower Middle Market acquisitions, the structure of Ben’s deal included the continued employment of the acquired company’s founders. But while that may satisfy the need for responsibility, it often removes control. This fact is one of the most important that business brokers and M&A specialists must be able to explain to clients. It’s part of managing the client’s expectations.

As with many Lower Middle Market acquisitions, the structure of Ben’s deal included the continued employment of the acquired company’s founders. But while that may satisfy the need for responsibility, it often removes control. This fact is one of the most important that business brokers and M&A specialists must be able to explain to clients. It’s part of managing the client’s expectations.

A business owner who has long been accustomed to calling the shots, suddenly discovers that his or her hands are tied; that decisions large and small are now being made by others. This has two impacts: 1) the emotional impact of the removal of power and, 2) the potential impact on the seller’s ultimate financial reward for selling.

The Brokers Roundtable℠, the online community for business brokers, business owners, Realtors and others in the business-for-sale industry, will mark the end of its 90-day Founders Membership period on July 31st. Members who join prior to August 1, enjoy a lifetime discounted membership fee of $115 for three months. Beginning on August 1, the membership fee will be increased to $175 every three months.

Created and hosted by Worldwide Business Brokers, The Brokers Roundtable℠ provides training, webinars, and connections with professionals from certified business appraisers, acquisition lenders, accountants, franchise specialists, transaction attorneys and business brokers in nearly a dozen countries.

Join live interviews and Q&As with industry professionals, weekly Office Hours to get questions answered and connect to the talent you need to sell, buy, broker or finance a business. You can sign up for The Brokers Roundtable℠ here.![]()

Addressing the first requires coming to grips with the fact that the business is no longer the seller’s. My experience working with sellers for more than 20 years is that, though never easy, such a mental transition requires having a realistic plan for both the deal itself and life post-closing.

As to the second impact, a portion of the seller’s financial benefit from the sale is often deferred either as a note or an earn-out agreement. Though having an experienced transaction attorney can help reduce this risk, this post is about the loss of control and the emotional impact of that loss.

The Bottom Line

In the wake of the sale of their business, the emotional impact on the seller can be significant. Brokers don’t always see it because once the sale is complete, brokers go on to the next deal and sellers – especially those that have no post-closing plan – often retreat to a emotional shelter as they try to come to grips with what they perceive as the loss of their “identity” as the owner of such-and-such business.

There’s a good chance that the buyer will want to change the business, sometimes in significant ways. They may, as in Ben’s case, strip out certain parts and even “dissolve the entire thing.” To the seller, this could seem like suicide or, worse, murder. But sellers have to understand that they no longer control the direction of what was once their “baby”. This is very often an extremely difficult hurdle to get over.

When selling a business, seller remorse is a very real condition in the aftermath of the sale. It’s incumbent upon brokers to try to prepare our clients for life after selling.

I’d like to hear from you. What topics would you like me to cover? How can we tailor these posts to be more useful to you and your business. Let me know in the comments box, below, or email me at

jo*@Wo*******************.com

.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

NOTE TO READERS: This is the final month our “Searching For…” feature will be included in our blog posts. We’re moving it to our online community, The Brokers Roundtable℠ and it will appear there exclusively beginning 1 August.

A U.S.-based investment firm has contacted us seeking light-duty emergency automotive services/roadside assistance businesses (jump starts, tire changes, lockouts, refueling) with $1 million in annual revenue anywhere in the U.S.

If any of you know of something that might fit, please let me know.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder, in 2001, of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 600 in the world. He can be reached at

jo*@Wo*******************.com