Selling a Business: Is It Worth It?

19 December 2022: Selling a Business: Is It Worth It?

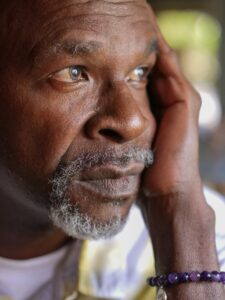

Selling a business is generally an arduous event; taxing the business owner mentally and emotionally – and sometimes even physically. In the more than 20 years we’ve been advising business owners (and business buyers), we’ve found that sometimes the best decision is not to sell.

The multiple processes of preparing the business for sale, preparing the owners and their families for the sale, the hectic and seemingly disorderly chaos of the negotiations and due diligence are sometimes more than some owners can tolerate.

Keeping It Alive

Managing a business efficiently – preserving or increasing its value – while at the same time providing the necessary level of focus on the marketing and sale of the company – while also maintaining a high level of confidentiality – can be a formidable task and grueling in the extreme. And efforts to do both simultaneously means an owner has a lot of balls in the air at any given time and this can lead to short tempers, fractured partnerships and damaged marriages among other complications that can mess up one’s otherwise tranquil life. But equally important, it can lead to lower business valuations.

Managing a business efficiently – preserving or increasing its value – while at the same time providing the necessary level of focus on the marketing and sale of the company – while also maintaining a high level of confidentiality – can be a formidable task and grueling in the extreme. And efforts to do both simultaneously means an owner has a lot of balls in the air at any given time and this can lead to short tempers, fractured partnerships and damaged marriages among other complications that can mess up one’s otherwise tranquil life. But equally important, it can lead to lower business valuations.

__________________________________________________________________________________

We offer a comprehensive coaching program – both group coaching in our Brokers’ Roundtable community as well as one-on-one coaching – tailored to Realtors, business owners , buyers and anyone interested in valuing, buying or selling a business.

If you’d like to learn more, email me at

jo*@Wo*******************.com

___________________________________________________________________________________

Selling a Business: Staying Focused

It is highly unlikely that a business owner can focus on both the efficient management of their business and the marketing and sale of that business at the same time. Would you want your surgeon to be focusing on a video to improve his golf swing while removing your daughter’s gall bladder? Like the business owner, it’s not likely that either of these important tasks will be done well.

It is highly unlikely that a business owner can focus on both the efficient management of their business and the marketing and sale of that business at the same time. Would you want your surgeon to be focusing on a video to improve his golf swing while removing your daughter’s gall bladder? Like the business owner, it’s not likely that either of these important tasks will be done well.

For the business owner, one of the downside results – and there are several – is that the business, which is no longer the main focus of the owner, will be negatively impacted. Such impact will begin to manifest in lowering value.

Assuming there is no disastrous precipitating event such as a death or divorce, from an overall point of view, there are generally two questions to ask to determine if selling makes the most sense. The first is calculable: does the financial forecast work? By that we mean will the net proceeds of a sale allow the seller to live the life he or she envisions in the aftermath of the sale?

The second question is more complicated and more difficult to answer: Is the owner emotionally ready to walk away?

For many business owners, their sense of purpose is embodied in their ownership of the business. It was with me.

As some of you may know, in the mid-’90s I sold a business that wasn’t for sale. My sense of purpose immediately evaporated. I was lost for several weeks and it wasn’t until I found a new purpose that I was able to shake my funk and start to actually live again.

Selling a Business: The Numbers

The first question, of course, assumes that the business owner has been planning an exit for a few years and operating their business with that exit in mind. This generally means they have post-sale plans. But the scope of those post-sale plans should inform the seller as to what financial resources he or she will need to realize those plans.

A financial planner will come in quite handy in this situation but even if the owner wants to forego that talent, they must still analyze their financial situation, get an accurate estimate of their business’ value, an accurate estimate of their post-closing gain net of all closing costs and taxes, and an accurate estimate of the capital they’ll need to live the life they want when they walk out the door.

This process itself is emotionally draining and in many cases disheartening. But it must be done.

This process itself is emotionally draining and in many cases disheartening. But it must be done.

If the business owner plans to retire to a life of pickle ball, a certain category of bank account is required. On the other hand, of the owner plans to compete with the Big Dog or compete with Elon in a race to the Moon, a totally different sort of bank account will be necessary.

And if the plans are the latter but the resources afford only the former, disillusion and depression will likely follow the sale.

Selling a Business: The Emotions

The second question – is the owner emotionally ready to walk away – is a completely different animal.

Selling a business is often a life-altering event and the aftermath can involve many second thoughts, unpleasant emotions and regrets. Being prepared takes time, planning and a purpose that the owner can transition into smoothly.

We’ve seen many business owners who, even those with concrete plans for their life after selling, suddenly feel lost when they immediately become ex-business owners. Their sense of identity has, for many years, been that of the owner of their business. Now, all of a sudden, they’re no longer that person. And until they find their “new” identity, they’re likely to muddle about seeming a bit confused – which is exactly what happened to me when I sold my own business back in the mid-’90s.

We’ve seen many business owners who, even those with concrete plans for their life after selling, suddenly feel lost when they immediately become ex-business owners. Their sense of identity has, for many years, been that of the owner of their business. Now, all of a sudden, they’re no longer that person. And until they find their “new” identity, they’re likely to muddle about seeming a bit confused – which is exactly what happened to me when I sold my own business back in the mid-’90s.

One day, I was the owner of a six year-old business. The next day, I wasn’t; and I couldn’t figure out what I was. It was very unnerving and disorienting.

_____________________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to accurately value and successfully sell businesses.

For many business owners, their sense of purpose is so intertwined with the business they’ve built over the years that the sudden loss of that business – the sudden loss of their purpose – due to a sale creates a deep and tangible sense of loss, the abrupt and substantial increase in their personal piggy bank notwithstanding.

The Bottom Line

While there are dozens of reasons to sell a business and to get the highest valuation, timing is important on many levels.

Yes, the market must be right, the valuation must be right, the business’ growth trend must be right, reasonable financing terms must be available, and qualified buyers must be looking. But even if all those boxes are checked, it’s important to determine if it’s the right time to sell from a life perspective in addition to a financial one.

If the business owner isn’t emotionally ready to walk away from the business they may have spent many years building, selling may not be a very wise move. Professional business brokers know that giving such advice is usually in the best interest of our clients – even while realizing that it may delay earning a commission for a couple of years.

I’d like to hear from you. What topics would you like me to cover? How can we tailor these posts to be more useful to you and your business. Let me know in the comments box, below, or email me at

jo*@Wo*******************.com

.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

We’ve been contacted by a private investment firm looking for opportunities in safety equipment manufacturing, software monitoring, contract landscaping and packaging with minimum of $1 million in discretionary earnings/EBITDA. Continental U.S.-based.

If any of you know of something that might fit, please let me know.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder, in 2001, of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 500 in the world. He can be reached at

jo*@Wo*******************.com