Selling a Business When It’s Not For Sale:

Due Diligence

28 March 2022: Selling a Business When It’s Not For Sale: Due Diligence

Selling a business when it’s not for sale involves the business owner doing a couple of dances – and with different “partners”. Those “partners” include an attorney, a business broker or M&A consultant, a financial planner and a couple of others, some of whom we discussed at various points in the last three posts.

Selling a business when it’s not for sale involves the business owner doing a couple of dances – and with different “partners”. Those “partners” include an attorney, a business broker or M&A consultant, a financial planner and a couple of others, some of whom we discussed at various points in the last three posts.

But in this, the fourth installment in our series on selling a business that’s not for sale, we focus on the “Dance of Due Diligence”, a generally haphazardly-orchestrated tango between buyer and seller, each of whom often appear to be listening to completely different pieces of music. Watching this from afar often calls to mind Elaine Bennis dancing on “Seinfeld”.

But due diligence is a dance that must be endured by the business owner because no one will actually pay for the business without knowing exactly what they’re paying for.

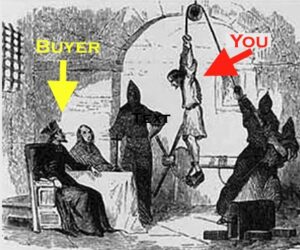

The Inquisition

Due diligence for the acquisition of a business has often been described but sellers as a visit to the proctologist’s office but with less civility; extremely invasive. And some business owners take umbrage at the level of detail a potential buyer expects to see.

Due diligence for the acquisition of a business has often been described but sellers as a visit to the proctologist’s office but with less civility; extremely invasive. And some business owners take umbrage at the level of detail a potential buyer expects to see.

But if the owner gave this even a modicum of thought, they would realize that, if they were offering to pay a couple of million bucks for a business, they would want to turn over every single rock and even pebble to make sure there were no surprises lurking in the weeds that might conceivably come back to bite them in the butt a year or two after the deal was done.

We offer a comprehensive coaching program tailored to Realtors, business owners and anyone interested in buying or selling a businesses.

If you’d like to learn more, email me at jo*@*******************og.com

Buyers will want to dig deeply into all aspects of the business to make sure they’re getting what they think they’re getting. If not prepared for, the due diligence dance can be extremely time-consuming; and most business owners – especially those whose business is not for sale – are definitely not prepared for it.

Where to Start?

Now, it’s difficult to know everything that a buyer will ask for but there are certain elements that are always part of the due diligence dance and that, if kept reasonably current, have the potential to make that dance significantly less painful. The most obvious of these are the financial documents.

We deal with business owners all the time – both during the selling process or when we’re doing periodic valuations for them – whose financials are a mess. These often incoherent documents are dumped on the accountant 30 days before tax deadlines in the hope that the accountant can straighten it all out – at least to the extent that no red flags are raised at the revenuer’s department.

But the scrutiny the tax man will give your financials will pale in comparison to what a buyer will do. After all, the tax man has zero liability in the event he overlooks something; he’ll get paid on Friday without regard to his accuracy. A buyer, on the other hand, is contemplating draining the family’s retirement savings and giving it all to you – by buying your business. If you look at the due diligence dance in that light, I suspect you can appreciate the buyer’s concerns.

___________________________________________________________________________________________________

REALTORS! Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to value and sell businesses.

Don’t Miss Out on the Coming “Silver Tsunami”!

The Materials

Again, you can only be so prepared for the possibility that someone – maybe us! – shows up at your door to say they want to buy your business. But to the extent modest preparation is both possible and not overly burdensome, any business owner would be wise to have data that will assuredly be required readily available. Here are some examples:

• Tax returns for the most recent three to five years.

• Financial statements, preferably audited or prepared by a CPA, for the same time period.

• Current financials; i.e. year-to-date/month end

• Copies of all leases for any real estate and equipment

• Organizational documents

• Any special licenses and the business license.

• Current certificate from the proper authority (SCC in the U.S.) that the business is “in good standing”.

• List of assets.

• Estimate of inventory value (at cost).

There will , of course, be a lot of other data that buyers will request and producing all the requested minutia will take time away from running your business. Having the above items organized and readily available will give you a jump start on the document production and make the process somewhat more tolerable.

Clean Up on Aisle 4

Every business has some skeletons in the closet just waiting for an opportunity to pop out and scare the bejesus out of everybody – and most business owners, rather than cleaning that closet out, keep it tightly closed until it’s forced open when, of course, it’s too late to clean it.

Every business has some skeletons in the closet just waiting for an opportunity to pop out and scare the bejesus out of everybody – and most business owners, rather than cleaning that closet out, keep it tightly closed until it’s forced open when, of course, it’s too late to clean it.

Some of those skeletons are unresolved tax problems, disputed payables or receivables, contract disputes, ongoing litigation, debts to or from the owners, uncollectable receivables, outdated inventory and the like.

These are all issues that, if ignored, will surface like the U.S. submarine Dallas doing that emergency blow the film Hunt for Red October and they will do so at the most inopportune moment, I assure you.

Settle any disputes, write off the uncollectable debt, get your accountant on the tax problems, cull the inventory, pay yourself (or other shareholders) back to get that debt of the books – or, if you or other shareholders owe the company, pony up, lad! Any buyer will be doing some serious digging and that “closet” will be found and its contents will come tumbling out causing a nasty mess that could derail any potential deal.

The Bottom Line

Not unlike last week’s installment on negotiating when selling a business that’s not for sale, the sale of a business requires providing seemingly countless and insignificant records, many of which the seller may deem to to be nothing more that an effort on the part of the potential buyer to wear the seller down; to beat him into submission.

But that’s not the case.

Remember, the buyer doesn’t know your business and, in the buyer’s mind, buying it represents a BIG gamble. As professional business brokers, it’s our job to make the purchase as easy as possible for the buyer. The owner of any business should have the same objective.

Next week’s post on selling a business when it’s not for sale, the final post in this series, will be about financing; how the acquisition will likely be financed – and how you might structure the sale to keep more of the money you’ve worked so hard for from ending up in the hands of government officials who’ve spent years demonstrating that they have no idea how to spend it wisely.

Next week’s post on selling a business when it’s not for sale, the final post in this series, will be about financing; how the acquisition will likely be financed – and how you might structure the sale to keep more of the money you’ve worked so hard for from ending up in the hands of government officials who’ve spent years demonstrating that they have no idea how to spend it wisely.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

Searching For…

This week we received an inquiry from a buyer of B2B services and B2B manufacturing businesses based in the continental U.S. with revenue of between $5M and $25M. No Discretionary minimums stated.

If any of you know of something that might fit, please let me know.

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

The author is the founder of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 1,000 in the world. He can be reached at jo*@*******************og.com